nj payroll tax calculator 2020

Our free tax calculator is a great way to learn about your tax situation and plan ahead. Americas 1 tax preparation provider.

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

E-File With Income Tax Software.

. Social Security. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Offer valid for returns filed 512020 - 5312020.

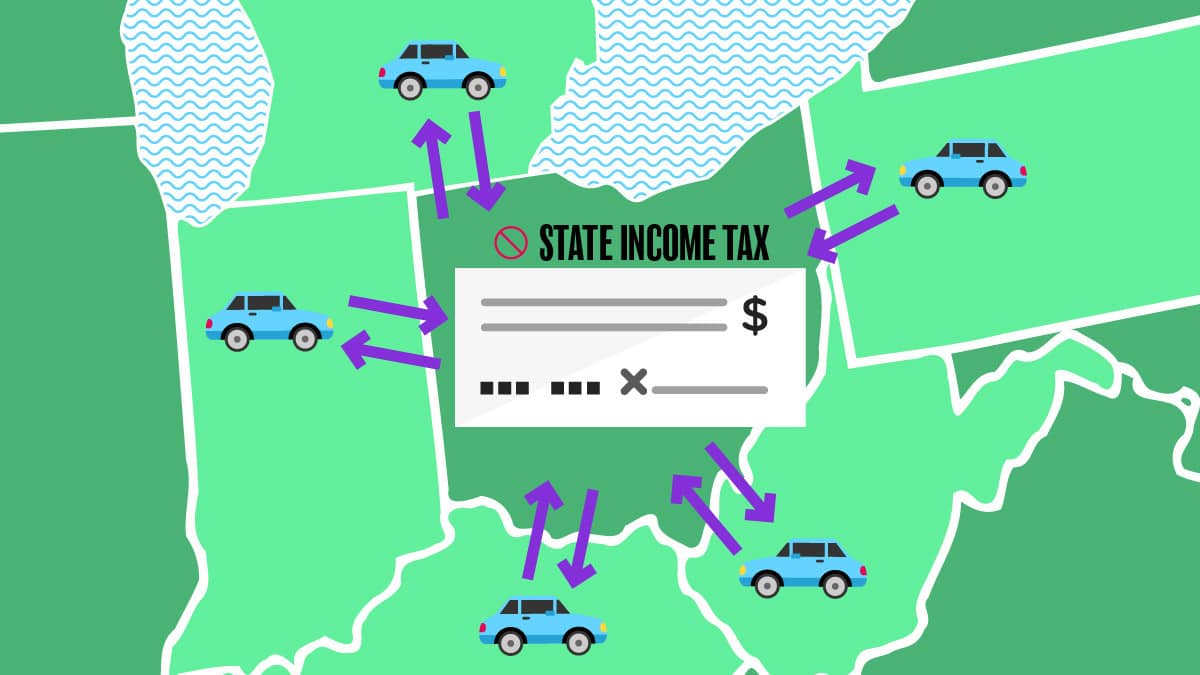

Single Married Filing Separately. The latest Internal Revenue Service IRS data shows New Jersey experienced a net outflow of 23 billion in Individual Income Tax Return Adjusted Gross Income AGI for tax year 2019-2020. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Self-Employed defined as a return with a Schedule CC-EZ tax form. 8900 125000. With this added net loss of AGI New Jerseys total net loss is approximately 364 billion dating back to data year 2004-2005.

Figure out your filing status. So the tax year 2022 will start from July 01 2021 to June 30 2022. When you mail a tax return you need to attach any documents showing tax withheld such as your W-2s or any 1099s.

Get HR Block 2020 Back Editions tax software federal or state editions for 2020. This calculator is for 2022 Tax Returns due in 2023. What Retailers Need to Know about NJ Sales Tax Holiday Starting Saturday NJ Sports Agent Aaron Reilly Talks of Unlikely NBA Journey on Minding Your Business This Weekend IRS Refunding 12 Billion in Late-Filing Penalties for 2019 2020 Tax Returns.

If approved you could be eligible for a credit. Work out your adjusted gross income. View The Income Tax FAQ.

Calculating your South Carolina state income tax is similar to the steps we listed on our Federal paycheck calculator. Calculating your Oregon state income tax is similar to the steps we listed on our Federal paycheck calculator. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

Start tax preparation and filing taxes for 2020 with HR Block 2020 Back Editions. Filing Quarterly Estimated Taxes. There is no state-level payroll tax.

South Carolina tax year starts from July 01 the year before to June 30 the current year. Learn More About Income Taxes. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

How Marginal Tax Brackets Work. Check cashing fees may also apply. TurboTax will not know anything about your mailed return and will continue to show Ready to Mail on your account.

TurboTax will not know that you put your tax return in an envelope and took it to a mailbox. Check cashing not available in NJ NY RI VT and WY. 1 online tax filing solution for self-employed.

Income Tax Calculator. Figure out your filing status. No cash value and void if transferred or where prohibited.

Small Business Tax Spreadsheet Business Worksheet Small Business Finance Small Business Bookkeeping

Tax Calculator Estimate Your Income Tax For 2022 Free

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

A New Form W 4 For 2020 Alloy Silverstein

What Are Marriage Penalties And Bonuses Tax Policy Center

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Reciprocal Agreements By State What Is Tax Reciprocity

Tax Payroll Calculator Clearance 60 Off Www Enaco Com Pe

New Jersey Nj Tax Rate H R Block

State W 4 Form Detailed Withholding Forms By State Chart

Payroll Tax What It Is How To Calculate It Bench Accounting

2021 New Jersey Payroll Tax Rates Abacus Payroll

State Corporate Income Tax Rates And Brackets Tax Foundation